ABA Routing Numbers are indispensable tools that facilitate the smooth flow of financial transactions within the banking ecosystem. If you've ever wondered how banks manage to transfer funds seamlessly, this guide will walk you through everything you need to know about ABA Routing Numbers. From their historical origins to their modern-day applications, we’ll delve into every aspect in detail.

In today's digital age, whether you're setting up direct deposits, paying bills online, or transferring funds between accounts, knowing your ABA Routing Number is more important than ever. This article will break down what ABA Routing Numbers are, why they matter, and how they function to ensure your transactions are both secure and efficient. By the end of this guide, you'll have a thorough understanding of how to leverage ABA Routing Numbers for your financial needs.

Join us as we explore the intricacies of banking and routing numbers, empowering you to take full control of your financial transactions. Let's dive in!

Read also:Kathleen Quinlan A Cinematic Legacy

Table of Contents

- What Are ABA Routing Numbers?

- The Evolution of ABA Routing Numbers

- Decoding the Structure of an ABA Routing Number

- How ABA Routing Numbers Function

- Why ABA Routing Numbers Are Essential

- How to Locate Your ABA Routing Number

- Practical Applications of ABA Routing Numbers

- ABA vs. ACH Routing Numbers: Key Differences

- Ensuring Security and Preventing Fraud

- Final Thoughts

What Are ABA Routing Numbers?

An ABA Routing Number, also referred to as a Routing Transit Number (RTN), is a nine-digit code used by financial institutions in the United States to uniquely identify banks or credit unions. This number plays a pivotal role in ensuring that funds are routed accurately during various transactions, such as direct deposits, wire transfers, and check processing.

Introduced by the American Bankers Association (ABA) in 1910, the ABA Routing Number system was designed to simplify banking operations and enhance efficiency. Over the decades, it has evolved to become an integral part of the U.S. banking infrastructure, supporting both traditional and modern financial services.

Each ABA Routing Number corresponds to a specific financial institution and branch location, making it an indispensable tool for verifying the legitimacy of financial transactions. Its precision ensures that funds reach their intended destinations without error.

The Evolution of ABA Routing Numbers

The origins of ABA Routing Numbers can be traced back to the early 20th century, when the American Bankers Association recognized the need for a standardized system to manage the growing complexity of banking transactions. Initially, the system was primarily utilized for check clearing, but its capabilities have expanded significantly over the years to encompass electronic payments and other financial services.

With the rise of electronic banking, ABA Routing Numbers have become even more critical. They now form the backbone of the Automated Clearing House (ACH) network, which processes billions of transactions annually. This network enables the efficient transfer of funds between accounts, ensuring that payments are executed promptly and accurately.

Today, ABA Routing Numbers remain a cornerstone of the U.S. financial system, underpinning the secure and reliable movement of funds across the nation and beyond.

Read also:Discover The Inspiring Journey Of Emily Camp

Decoding the Structure of an ABA Routing Number

Breaking Down the Nine-Digit Code

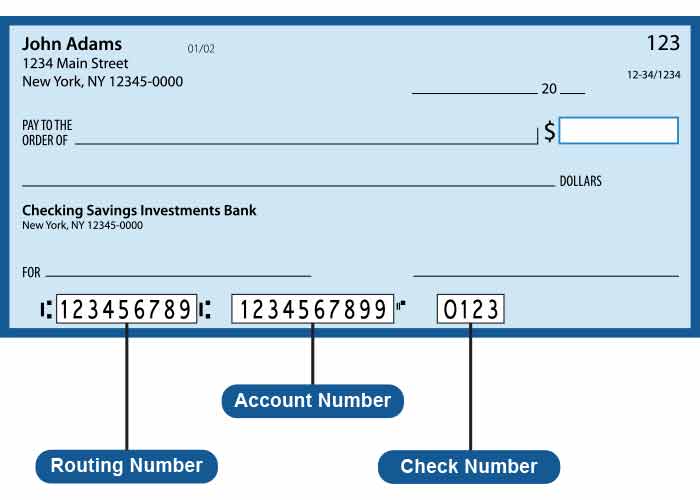

An ABA Routing Number comprises nine digits, each serving a specific purpose. Understanding its structure can help you verify its authenticity and mitigate the risk of fraud. Here's a detailed breakdown:

- First Four Digits: These digits represent the Federal Reserve Routing Symbol, which identifies the Federal Reserve Bank responsible for processing transactions for the financial institution.

- Next Four Digits: These digits pinpoint the specific financial institution or branch location, ensuring precise identification.

- Last Digit: The final digit functions as a checksum, utilizing a mathematical algorithm to confirm the validity of the routing number.

By understanding the structure of an ABA Routing Number, you can better appreciate its role in maintaining the integrity of financial transactions.

How ABA Routing Numbers Function

ABA Routing Numbers serve as a standardized system for identifying financial institutions during transactions. When you initiate a transfer, the routing number ensures that the funds are directed to the correct bank or credit union. This process is fundamental to maintaining the accuracy and security of financial transactions.

For instance, when setting up a direct deposit, your employer will require your ABA Routing Number and account number to ensure that your paycheck is deposited into the right account. Similarly, when writing a check, the routing number printed at the bottom ensures that the funds are withdrawn from the correct account.

This system of identification is crucial for upholding the reliability and security of financial transactions, ensuring that funds are transferred without errors or delays.

Why ABA Routing Numbers Are Essential

Key Benefits of ABA Routing Numbers

ABA Routing Numbers are indispensable for several reasons, each contributing to the efficiency and security of financial transactions:

- Accuracy: They ensure that funds are routed to the correct financial institution, minimizing the risk of errors.

- Security: They play a vital role in preventing fraud by verifying the authenticity of transactions.

- Efficiency: They streamline the process of transferring funds, reducing processing times and enhancing convenience.

- Global Connectivity: They facilitate seamless communication between U.S. banks and international financial systems, enabling cross-border transactions.

Without ABA Routing Numbers, the banking system would face significant challenges in processing transactions efficiently and securely, underscoring their critical importance in modern finance.

How to Locate Your ABA Routing Number

Where to Find Your Routing Number

Finding your ABA Routing Number is a simple process. Here are some common methods to help you locate it:

- On Your Checks: The routing number is typically printed at the bottom of your checks, usually in the first set of numbers.

- Online Banking: Most banks provide your routing number through their online banking platforms, making it easily accessible.

- Bank Statement: Your routing number may also be listed on your monthly bank statement, offering another convenient option for verification.

- Contact Your Bank: If you're unsure where to find your routing number, reach out to your bank's customer service for assistance.

It's important to note that different branches of the same bank may have distinct routing numbers, so always confirm the correct number for your specific branch to avoid any complications.

Practical Applications of ABA Routing Numbers

Everyday Uses of Routing Numbers

ABA Routing Numbers are utilized in a variety of financial transactions, enhancing convenience and efficiency in managing your finances. Some common applications include:

- Direct Deposits: Setting up automatic deposits for paychecks, government benefits, or other recurring payments.

- Bill Payments: Paying bills online or through automated payment systems, streamlining your financial management.

- Wire Transfers: Transferring funds between accounts domestically or internationally, ensuring quick and secure transactions.

- ACH Transfers: Facilitating electronic payments and transfers through the ACH network, offering a cost-effective and reliable solution for moving funds.

By understanding the diverse applications of ABA Routing Numbers, you can better manage your finances and take full advantage of the services they provide.

ABA vs. ACH Routing Numbers: Key Differences

Understanding the Distinction

While ABA Routing Numbers and ACH Routing Numbers are often used interchangeably, there is a subtle difference between the two. ABA Routing Numbers are primarily employed for check processing, whereas ACH Routing Numbers are specifically designed for electronic transactions through the Automated Clearing House network.

In most cases, the same nine-digit code serves as both an ABA Routing Number and an ACH Routing Number. However, some banks may use separate codes for different types of transactions. To ensure accurate processing, always verify the correct routing number with your bank.

Ensuring Security and Preventing Fraud

Protecting Your Financial Information

Security is paramount when it comes to ABA Routing Numbers. Financial institutions implement various measures to safeguard these numbers from unauthorized use and fraud. To protect your routing number, consider the following best practices:

- Keep It Confidential: Avoid sharing your routing number unnecessarily, especially online or over the phone.

- Monitor Transactions: Regularly review your account activity for any suspicious transactions and report them promptly.

- Secure Online Accounts: Use strong, unique passwords and enable two-factor authentication for your online banking accounts to enhance security.

By adhering to these precautions, you can help safeguard your financial information and minimize the risk of fraud.

Final Thoughts

In summary, ABA Routing Numbers are a fundamental component of the U.S. banking system, enabling secure and efficient financial transactions. Understanding their structure, significance, and practical applications can empower you to manage your finances more effectively and confidently.

We encourage you to verify your ABA Routing Number and take steps to ensure its security. If you have any questions or require further clarification, feel free to leave a comment below. Additionally, explore other articles on our site for more valuable insights into personal finance and banking.

References:

- American Bankers Association (ABA)

- Federal Reserve Bank

- National Automated Clearing House Association (NACHA)