In the modern digital era, accessing your Fifth Third Bank account online has become an indispensable tool for managing personal and business finances. As one of the premier financial institutions in the United States, Fifth Third Bank provides a sophisticated online banking platform designed to offer convenience, robust security, and comprehensive control over your accounts. Whether you're reviewing balances, initiating fund transfers, or handling bill payments, understanding the login process and navigating the system efficiently can significantly enhance your banking experience.

Fifth Third Bank has consistently remained at the cutting edge of technological innovation within the banking sector. The institution's dedication to delivering seamless online banking services ensures that customers can manage their finances with ease. From intuitive mobile applications to user-friendly desktop interfaces, Fifth Third Bank offers a diverse range of tools tailored to meet the needs of every user.

This comprehensive guide explores the intricacies of logging into Fifth Third Bank, offering detailed instructions, security recommendations, and solutions to common issues. Whether you're a new user or an experienced customer, this resource aims to deepen your understanding and boost your confidence in leveraging Fifth Third Bank's advanced online services.

Read also:Discovering The Remarkable Life And Achievements Of James Pader

Table of Contents

- Overview of Fifth Third Bank

- Navigating the Fifth Third Bank Login Process

- Strengthening Security During Login

- Exploring Key Features of Fifth Third Bank Online Services

- Resolving Common Login Challenges

- Maximizing the Fifth Third Bank Mobile App

- Advantages of Online Banking with Fifth Third Bank

- Answers to Frequently Asked Questions About Fifth Third Bank Login

- Statistical Insights on Digital Banking Trends

- Summary and Next Steps

Overview of Fifth Third Bank

Historical Background and Legacy

Fifth Third Bank, headquartered in Cincinnati, Ohio, boasts a storied history that spans over 160 years. Established in 1858, the bank has evolved into one of the largest financial institutions in the United States, serving millions of customers across numerous states. Its unwavering commitment to innovation and exceptional customer service has solidified its position as a leader in the banking industry. The bank's name, "Fifth Third," originates from its original location at the intersection of Fifth and Third Streets in Cincinnati. Over the decades, Fifth Third Bank has expanded its offerings to encompass a wide array of financial products, ranging from personal banking solutions to comprehensive commercial lending services.

Navigating the Fifth Third Bank Login Process

Step-by-Step Instructions for Secure Access

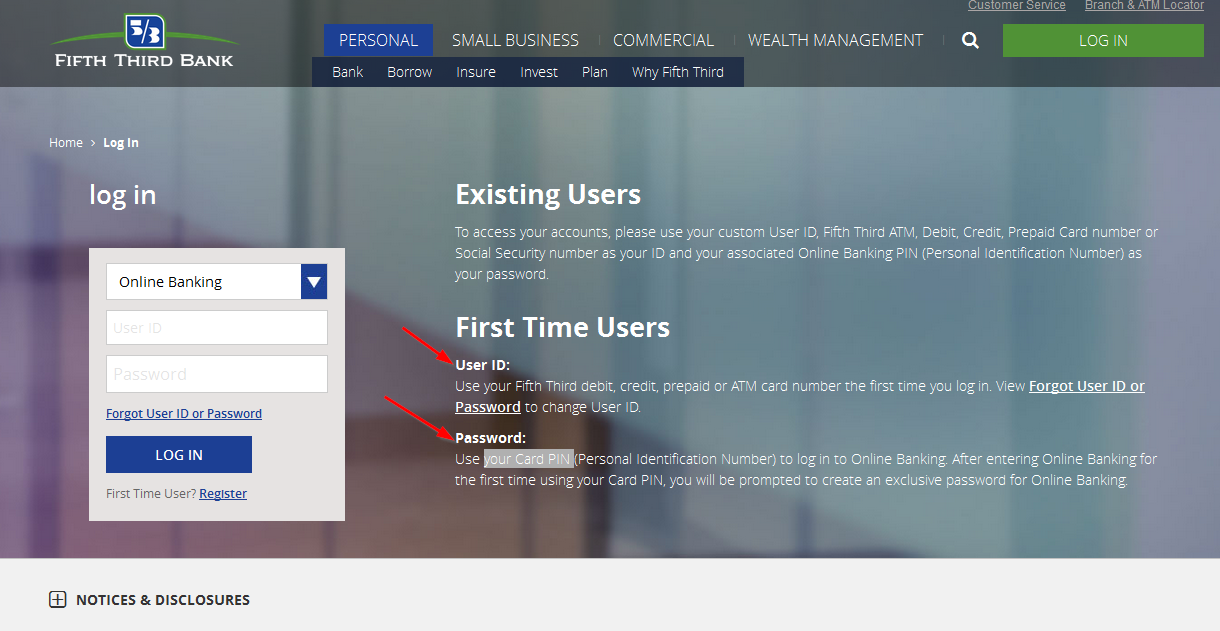

Gaining access to your Fifth Third Bank account online is a simple and straightforward procedure. Follow these detailed steps to ensure a seamless login experience:

- Visit the official Fifth Third Bank website or launch the mobile app.

- Input your username or email address into the designated field.

- Enter your password securely, ensuring no one is watching you.

- Click the "Sign In" button to gain access to your account dashboard.

To enhance security, Fifth Third Bank implements multi-factor authentication, requiring users to verify their identity through additional methods, such as a text message or authentication app. This additional layer of protection ensures that your account remains safe from unauthorized access.

Strengthening Security During Login

Practical Tips for Safeguarding Your Financial Information

Protecting your financial data is of utmost importance. Below are some effective strategies to bolster security when logging into Fifth Third Bank:

- Create strong, unique passwords that incorporate a combination of uppercase and lowercase letters, numbers, and special characters.

- Enable two-factor authentication to add an extra layer of security to your account.

- Avoid logging in on public Wi-Fi networks, as these environments may not be secure and could expose your credentials.

- Regularly review your account activity for any signs of suspicious transactions and report any irregularities to Fifth Third Bank immediately.

Fifth Third Bank employs advanced encryption technology to safeguard user data, ensuring that every online banking session is secure and protected.

Exploring Key Features of Fifth Third Bank Online Services

Empowering Financial Management with Comprehensive Tools

Fifth Third Bank's online platform offers a variety of powerful features designed to simplify and streamline financial management:

Read also:Is Tampa Airport Closed A Comprehensive Guide To Tpa Operations

- Unified Account Overview: Gain a comprehensive view of all your accounts, including checking, savings, and credit card balances, in a single, easy-to-navigate dashboard.

- Efficient Bill Payment: Schedule and pay bills directly from your account, eliminating the need for paper checks and reducing administrative burdens.

- Seamless Fund Transfers: Transfer funds effortlessly between your accounts or send money to other users with just a few clicks.

- Customizable Alerts and Notifications: Stay informed about account activity and important updates through timely email or text message alerts.

These innovative features empower users to take full control of their finances, enabling them to make well-informed decisions and achieve their financial goals.

Resolving Common Login Challenges

Effective Solutions to Address Frequent Issues

From time to time, users may encounter obstacles when attempting to log in to their Fifth Third Bank account. Below are some common challenges and their corresponding solutions:

- Forgotten Password: Utilize the "Forgot Password" feature to securely reset your password and regain access to your account.

- Account Lockout: If your account becomes locked due to multiple incorrect login attempts, reach out to Fifth Third Bank's customer service team for prompt assistance.

- Technical Difficulties: Clear your browser cache or try accessing the site from a different device if you encounter technical glitches.

Fifth Third Bank provides dedicated customer support to help users address and resolve any login-related issues quickly and efficiently.

Maximizing the Fifth Third Bank Mobile App

Experience Convenience with the Mobile App

The Fifth Third Bank mobile app delivers all the functionalities of the desktop platform in a sleek, user-friendly interface. Key features of the app include:

- Real-time account updates and detailed transaction histories for up-to-the-minute insights into your financial status.

- Mobile check deposit capabilities, allowing you to deposit checks conveniently from your smartphone without visiting a branch.

- Location-based services to help you locate nearby ATMs and branches, ensuring you always have access to banking services when you need them.

Downloading and installing the app is a straightforward process, and it is compatible with both iOS and Android devices, offering unmatched accessibility and convenience.

Advantages of Online Banking with Fifth Third Bank

Why Choose Fifth Third Bank for Your Digital Banking Needs?

Fifth Third Bank's online banking services provide numerous benefits that cater to both individuals and businesses:

- Unparalleled Convenience: Access your accounts 24/7 from anywhere in the world with just a few clicks, giving you the flexibility to manage your finances on your schedule.

- Industry-Leading Security: Benefit from advanced encryption and multi-factor authentication protocols that ensure your personal and financial data remains secure at all times.

- Enhanced Efficiency: Automate routine financial tasks, such as bill payments and fund transfers, saving you time and allowing you to focus on more critical priorities.

These advantages make Fifth Third Bank a top-tier choice for those seeking reliable, cutting-edge online banking solutions.

Answers to Frequently Asked Questions About Fifth Third Bank Login

Clarifying Common Queries

Below are responses to some of the most frequently asked questions regarding Fifth Third Bank login:

- Q: Is it possible to use the same login credentials for both the website and mobile app?

- Q: What steps should I take if I suspect unauthorized access to my account?

A: Absolutely! Your login credentials are consistent across all Fifth Third Bank platforms, ensuring a seamless transition between devices.

A: Contact Fifth Third Bank's customer service team immediately to report the issue and initiate the necessary security measures to protect your account.

Statistical Insights on Digital Banking Trends

Data Supporting the Rise of Online Banking

A report by the Federal Reserve highlights that approximately 86% of consumers utilize online banking services, with mobile banking adoption growing at a rapid pace. Fifth Third Bank aligns with these trends by continuously enhancing its digital platforms to meet evolving customer expectations.

Research also indicates that users who incorporate online banking tools into their financial routines are more likely to achieve their financial objectives. This is attributed to greater visibility into spending patterns and account balances, empowering users to make more informed decisions.

Summary and Next Steps

In summary, mastering the Fifth Third Bank login process is essential for unlocking the full potential of convenient and secure financial management. By adhering to the guidelines and best practices outlined in this guide, you can ensure a smooth and secure online banking experience. We encourage you to share your insights and experiences in the comments section below and explore additional resources on our site to further enrich your financial literacy. Together, let's work toward achieving a brighter financial future through informed decision-making and effective resource utilization.