Deciphering banking terminology can be daunting, particularly when terms like ABA routing number and routing number arise. Many individuals wonder, "Are ABA routing numbers and routing numbers the same?" This article aims to unravel this concept and provide clear insights into the topic. Whether you're managing personal finances or overseeing business operations, understanding the nuances of these terms is essential for efficient banking.

In today's fast-paced digital era, where financial transactions occur almost instantaneously, having a firm grasp of banking terminology is more important than ever. ABA routing numbers serve as the backbone of accurate fund transfers between accounts. This article will explore ABA routing numbers in depth, discussing their origins, functionality, and relationship with general routing numbers.

As we delve into this topic, we'll examine various aspects, including the historical context of ABA routing numbers, their applications, and their significance in contemporary banking. By the conclusion of this article, you'll possess a thorough understanding of whether ABA routing numbers are synonymous with routing numbers and how they influence your financial activities.

Read also:Discover The Elegance Of Monaco Pittsburgh A Kimpton Hotel

Contents Overview

- The Origins of ABA Routing Numbers

- Understanding ABA Routing Numbers

- The Role of ABA Routing Numbers

- Are ABA Routing Numbers and Routing Numbers Identical?

- Exploring Types of Routing Numbers

- Practical Uses of ABA Routing Numbers

- Key Distinctions Between ABA Routing Numbers and Other Codes

- Locating Your ABA Routing Number

- Safeguarding ABA Routing Numbers

- The Future of ABA Routing Numbers

- Summary and Next Steps

The Origins of ABA Routing Numbers

ABA routing numbers have a storied past that traces back to 1910. The American Bankers Association (ABA) pioneered these numbers to streamline the processing of checks and other financial transactions. Initially, they were primarily utilized for check clearing, but their utility expanded over time to encompass electronic transactions.

The advent of ABA routing numbers transformed the banking sector by establishing a standardized method for identifying financial institutions. This innovation enabled banks to process transactions more effectively and with greater precision. Today, ABA routing numbers continue to serve as a fundamental component of the financial infrastructure, ensuring funds are directed to the appropriate accounts.

Advancements in Routing Numbers

Throughout the years, routing numbers have adapted to technological progress. Originally designed exclusively for check processing, their scope broadened with the rise of electronic banking to include wire transfers, direct deposits, and other digital transactions. This evolution underscores the flexibility and significance of routing numbers in modern banking practices.

Understanding ABA Routing Numbers

An ABA routing number, also known as a routing transit number (RTN), is a nine-digit code assigned to financial institutions in the United States. It functions as a unique identifier for banks and credit unions, ensuring funds are accurately directed during transactions.

Each ABA routing number is distinct to a specific financial institution and branch, underscoring its importance in maintaining the integrity of the financial system. Through the use of ABA routing numbers, banks can process transactions efficiently and reduce the likelihood of errors.

Structure of an ABA Routing Number

- The first four digits signify the Federal Reserve routing symbol.

- The subsequent four digits denote the bank or financial institution.

- The final digit serves as a checksum, verifying the routing number's accuracy.

The Role of ABA Routing Numbers

ABA routing numbers are indispensable to the functioning of the financial system. They act as intermediaries between financial institutions, enabling the smooth transfer of funds. Whether you're depositing a check, setting up direct deposit, or initiating a wire transfer, ABA routing numbers guarantee your money reaches its intended destination.

Read also:Discovering Eminems Roots Birthplace And Early Life

When you supply your ABA routing number during a transaction, the financial institution verifies its authenticity and routes the funds to the correct account. This process is automated and executes within seconds, thanks to advanced banking systems.

Steps in the Routing Process

Below is an outline of how ABA routing numbers function during a typical transaction:

- The sender provides the ABA routing number along with account details.

- The financial institution authenticates the routing number and account information.

- The transaction is processed via the Federal Reserve or another clearinghouse.

- The funds are successfully transferred to the recipient's account.

Are ABA Routing Numbers and Routing Numbers Identical?

A frequently asked question in banking is, "Are ABA routing numbers and routing numbers the same?" The answer is affirmative; they are indeed the same. ABA routing numbers represent a specific type of routing number utilized in the United States. Both terms refer to the nine-digit code assigned to financial institutions for transaction processing.

Although these terms are often used interchangeably, it's important to recognize that routing numbers can differ based on the country and financial system. In the U.S., ABA routing numbers are the standard for domestic transactions.

Clarifying Terminology

To eliminate confusion, understanding the context in which these terms are used is beneficial:

- ABA Routing Number: Specifically pertains to routing numbers used within the U.S.

- Routing Number: A broader term that can encompass routing codes in other countries.

Exploring Types of Routing Numbers

Routing numbers come in various forms, each serving a distinct purpose. In addition to ABA routing numbers, there are other types of routing codes employed in international banking. Grasping the differences between these types is crucial for executing global transactions.

Some prevalent types of routing numbers include:

- SWIFT Codes: Utilized for international wire transfers.

- IBAN Codes: Identify bank accounts in countries outside the U.S.

- ABA Routing Numbers: Used for domestic transactions in the U.S.

Selecting the Appropriate Routing Number

When conducting a transaction, it's imperative to utilize the correct type of routing number. For domestic transactions within the U.S., an ABA routing number suffices. However, for international transactions, you may need to furnish additional details, such as a SWIFT code or IBAN.

Practical Uses of ABA Routing Numbers

ABA routing numbers are versatile and serve multiple purposes in the financial domain. Below are some of the most common applications:

- Direct Deposit: Employers leverage ABA routing numbers to deposit employee paychecks directly into their bank accounts.

- Bill Payments: Consumers can utilize ABA routing numbers to pay bills electronically.

- Wire Transfers: ABA routing numbers are essential for sending and receiving wire transfers.

- Check Processing: Banks rely on ABA routing numbers to process checks and ensure they are deposited into the appropriate accounts.

These applications emphasize the importance of ABA routing numbers in facilitating everyday financial transactions.

Advantages of Utilizing ABA Routing Numbers

Employing ABA routing numbers offers numerous advantages:

- Enhanced accuracy in transaction processing.

- Decreased risk of errors and fraud.

- Improved efficiency in banking operations.

Key Distinctions Between ABA Routing Numbers and Other Codes

Although ABA routing numbers resemble other types of routing codes, significant differences exist. These distinctions primarily concern geographic scope and functionality.

For instance, SWIFT codes are designed for international transactions, whereas ABA routing numbers are restricted to domestic transactions within the U.S. Recognizing these differences is vital for ensuring the success of your financial transactions.

Comparing ABA Routing Numbers and SWIFT Codes

Below is a comparison of ABA routing numbers and SWIFT codes:

| Feature | ABA Routing Number | SWIFT Code |

|---|---|---|

| Geographic Scope | Domestic (U.S.) | International |

| Length | 9 digits | 8-11 characters |

| Purpose | Domestic transactions | International wire transfers |

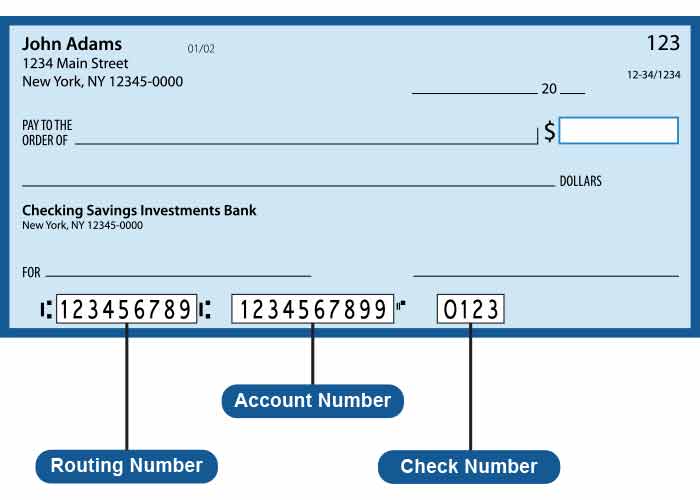

Locating Your ABA Routing Number

Identifying your ABA routing number is a simple process. You can find it in various locations, depending on your banking requirements. Below are some common methods:

- Bank Statements: Review your monthly bank statements for the routing number.

- Checks: The routing number is printed on the bottom left corner of your checks.

- Online Banking: Access your routing number through your bank's website or mobile app.

If you're uncertain about where to locate your routing number, contacting your bank's customer service is always a dependable option.

Verifying Your ABA Routing Number

It's crucial to verify your ABA routing number prior to initiating any transactions. Double-check the number to ensure its accuracy and consult your bank if you have any uncertainties. This precaution helps prevent errors and ensures the security of your transactions.

Safeguarding ABA Routing Numbers

Securing your ABA routing number is essential for protecting your financial information. While routing numbers are not as sensitive as account numbers, they should still be handled with care. Below are some recommendations for safeguarding your routing number:

- Keep It Confidential: Refrain from sharing your routing number unnecessarily.

- Use Secure Channels: Only provide your routing number through secure means, such as bank websites or in-person transactions.

- Monitor Your Accounts: Regularly review your bank statements for any unusual activity.

By adhering to these security measures, you can help shield your financial information and prevent potential fraud.

Identifying Potential Fraud

Remain vigilant for signs of fraud involving your ABA routing number. If you detect any unauthorized transactions or suspicious behavior, contact your bank promptly. Swift action can mitigate potential harm and ensure the security of your accounts.

The Future of ABA Routing Numbers

As technology progresses, the role of ABA routing numbers in the financial system will evolve. Developments in digital banking and the rise of fintech companies are reshaping how transactions are processed. While ABA routing numbers remain a critical component of the financial infrastructure, they may adapt to embrace new technologies and processes.

Looking forward, the future of ABA routing numbers could involve greater integration with digital platforms and advanced security measures. These innovations will ensure that routing numbers continue to meet the needs of consumers and businesses in an ever-evolving financial landscape.

Innovations in Routing Technology

Some potential advancements in routing technology include:

- Blockchain-based routing systems for enhanced security.

- Artificial intelligence-driven transaction processing for improved efficiency.

- Integration with mobile banking platforms for seamless user experiences.

Summary and Next Steps

In summary, ABA routing numbers play a pivotal role in the financial system, ensuring the accuracy and efficiency of transactions. While the terms "ABA routing number" and "routing number" are often used interchangeably, they both refer to the same nine-digit code utilized in the U.S. for domestic transactions.

Comprehending the functions and applications of ABA routing numbers is essential for effectively managing your finances. By following the tips and best practices outlined in this article, you can ensure the security of your transactions and optimize your banking experience.

We encourage you to take action by:

- Verifying your ABA routing number and safeguarding it appropriately.