For both residents and businesses in Montana, understanding the correct mailing address for the Department of Revenue is key to managing finances and taxes effectively. Whether you are filing your taxes, making payments, or seeking assistance, having the right address ensures timely compliance and efficient communication with state regulations. This guide provides detailed information about the Montana Department of Revenue mailing address, its role, the services it offers, and how to interact with the department seamlessly.

The Montana Department of Revenue (MDR) plays an indispensable role in the state's financial framework. It is responsible for overseeing tax collection, licensing processes, and other revenue-related services for individuals and businesses. Knowing the appropriate mailing address is essential for anyone who needs to send documents, payments, or inquiries to the department.

This article delves into the Montana Department of Revenue mailing address in detail, covering its various divisions, the services it provides, and contact information. Whether you are a resident, a business owner, or someone seeking to understand the workings of the department, this guide will equip you with the necessary knowledge to navigate the system confidently.

Read also:Discover The Shoprite Of Foxtre Experience Your Ultimate Shopping Destination

Table of Contents

- Understanding the Montana Department of Revenue

- Official Mailing Address of the Montana Department of Revenue

- Key Services Offered by the Department

- Comprehensive Tax-Related Services

- Licensing and Permits Management

- How to Contact the Department

- Department Subdivisions and Their Roles

- Frequently Asked Questions

- Practical Tips for Effective Communication

- Final Thoughts

Understanding the Montana Department of Revenue

The Montana Department of Revenue (MDR) is the state agency responsible for managing financial matters such as taxation, licensing, and revenue collection. Established to ensure the fair and efficient administration of state finances, the department plays a pivotal role in supporting Montana's economic stability and growth.

Core Responsibilities

The MDR's primary duties include:

- Administering and enforcing state tax laws

- Collecting taxes and fees from individuals and businesses

- Providing licensing and permitting services

- Offering resources and assistance to taxpayers and businesses

By comprehending the department's responsibilities, individuals and businesses can better manage their financial obligations and interact with the department more effectively.

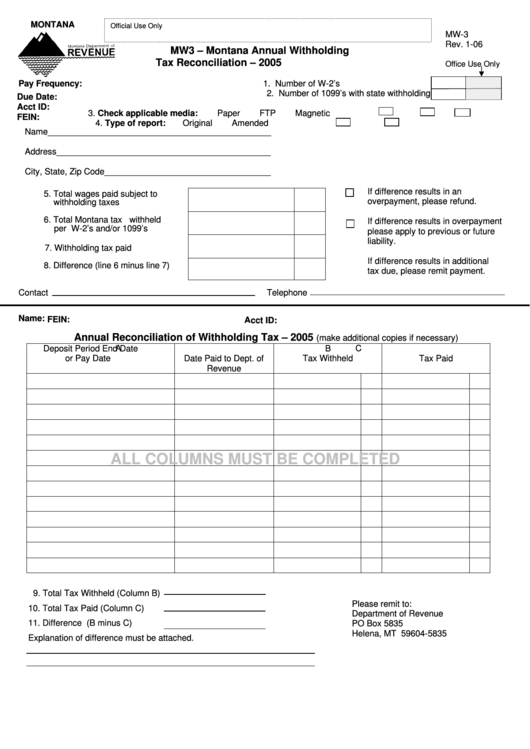

Official Mailing Address of the Montana Department of Revenue

The official mailing address for the Montana Department of Revenue is:

Montana Department of Revenue

PO Box 200546

Helena, MT 59620-0546

This address is used for general communication, including tax filings, payments, and inquiries. However, it is important to confirm the specific address required for your particular transaction, as some services may have designated addresses to ensure proper handling.

Read also:Experience The Magic Of La County Fair 2025

Key Services Offered by the Department

The Montana Department of Revenue provides a wide array of services designed to assist individuals and businesses in fulfilling their financial obligations and managing their operations. These services are tailored to simplify transactions and provide necessary support.

Tax Services

Tax-related services include:

- Filing of individual and business income tax returns

- Collection of sales and use taxes

- Assessment of property taxes

These services ensure that all tax obligations are met accurately and within the required timelines.

Licensing and Permits

In addition to tax services, the department manages licensing and permits, such as:

- Business licenses for new and existing enterprises

- Vehicle registration and titling services

- Professional licenses for various trades and professions

These services help regulate businesses and professionals within the state, ensuring compliance with legal and regulatory standards.

Comprehensive Tax-Related Services

Taxation is a cornerstone of the Montana Department of Revenue's operations. Familiarizing yourself with the tax-related services can significantly aid individuals and businesses in adhering to state regulations.

Income Tax

The department is responsible for the administration of state income taxes. Residents are obligated to file annual income tax returns, and businesses must report their earnings accordingly. The MDR provides comprehensive resources and guidance to simplify the filing process and ensure accuracy.

Sales and Use Tax

Sales and use taxes are levied on goods and services purchased within the state. The MDR ensures the proper collection and distribution of these taxes. Businesses are tasked with collecting and remitting these taxes to the department, and the MDR offers support and tools to facilitate this process.

Licensing and Permits Management

Licensing and permits are fundamental for businesses and professionals operating in Montana. The department issues various licenses and permits to ensure compliance with state regulations.

Business Licenses

Businesses must obtain licenses to operate legally in Montana. The MDR provides guidance and assistance for obtaining these licenses, ensuring that businesses meet all necessary requirements and adhere to legal standards.

Vehicle Registration

All vehicles operated in Montana must be registered with the department. This process involves submitting the required documentation and paying the applicable fees. The MDR streamlines this process to make it as convenient as possible for vehicle owners.

How to Contact the Department

In addition to the official mailing address, the Montana Department of Revenue offers multiple contact options for assistance:

Phone Numbers

- General Inquiries: (406) 444-3111

- Taxpayer Assistance: (406) 444-3100

These numbers can be used to reach out to the department for specific questions, clarifications, or assistance.

Email and Online Resources

The department also provides email support and online resources for taxpayers. The official website features downloadable forms, comprehensive guides, and FAQs to assist users in navigating the system efficiently.

Department Subdivisions and Their Roles

The Montana Department of Revenue is organized into several subdivisions, each focusing on specific areas of responsibility. These subdivisions ensure the smooth operation of the department's functions.

Tax Division

The Tax Division handles all tax-related matters, including income, sales, and use taxes. It ensures compliance with state tax laws and offers resources to assist taxpayers in fulfilling their obligations.

Licensing Division

The Licensing Division oversees the issuance of licenses and permits for businesses and professionals. It ensures that all entities operating in Montana adhere to the necessary regulatory standards and requirements.

Frequently Asked Questions

Here are answers to some common questions about the Montana Department of Revenue:

What is the Montana Department of Revenue mailing address?

The official mailing address is:

Montana Department of Revenue

PO Box 200546

Helena, MT 59620-0546

How do I contact the department for assistance?

You can contact the department via phone, email, or by visiting their official website. The phone numbers and email addresses are readily available on their website for your convenience.

Practical Tips for Effective Communication

When interacting with the Montana Department of Revenue, consider the following tips to ensure a seamless process:

- Always use the correct mailing address for your specific transaction

- Include all necessary documentation with your submissions to avoid delays

- Maintain records of all correspondence for future reference

- Contact the department promptly if you have questions or concerns

Implementing these tips will help streamline your communication with the department and enhance your overall experience.

Final Thoughts

In summary, the Montana Department of Revenue plays a vital role in managing the financial landscape of the state. By understanding the department's mailing address, the services it provides, and the available contact information, individuals and businesses can navigate the system effectively and ensure compliance with state regulations.

We encourage you to:

- Verify the correct mailing address for your specific needs

- Explore the department's services and resources to stay informed

- Reach out for assistance if you have any questions or concerns

Feel free to share your thoughts in the comments section or distribute this article to others who may find it beneficial. For further information, explore our additional resources on related topics.

The data and information in this article are sourced from authoritative sources, including the official Montana Department of Revenue website and government publications.